There’s a hidden gold story behind all of the minutiae of interest rate policy. In the meantime, there’s still a few weeks left to get into my favorite gold stock.

Let me explain…

As expected, the Federal Reserve cut rates for the 3rd time this year. As a reminder, the Fed cut rates 0.25% in September and October, and this final cut of the year brought rates down to between 3.5% and 3.75%.

This kind of ongoing rate cut policy is unusual considering everything else that’s going on in the market. Typically, the Fed cuts rates to stimulate the economy, boost lagging asset prices and increase the “wealth effect” by making people feel richer because their brokerage accounts and home values are rising.

But stock prices are near all-time highs. Asset prices are mostly near all-time highs.

It seems odd that the Fed is cutting rates into this strength, especially since rates are not remotely high, speaking historically.

Of course, the real problem is that rates are near 20-year highs… and high Federal Fund rates have a knock-on effect for Treasury yields.

So what gives?

The Fed is effectively trying to help keep Treasury interest costs down by lowering rates.

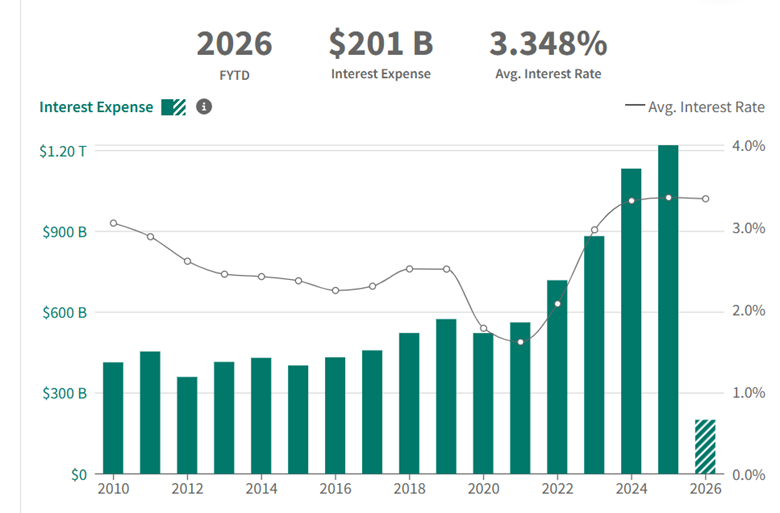

That’s great, in theory. Treasury interest expense has skyrocketed since the Fed raised rates to fight inflation in 2022…

Today, annual interest alone costs the Treasury over $1 trillion – up from ~$500 billion/year in 2020.

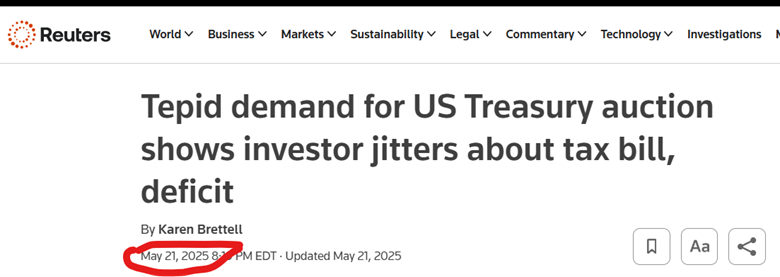

Growing interest costs are bad… but when the Fed cuts rates, it makes Treasury bonds less attractive to buyers.

Right? If you were reluctant to buy a Treasury security at 4%, you probably won’t be very happy to buy one at 3.75%…

Earlier this year, we already saw weak demand for Treasuries – before the rate cuts even began.

But don’t worry… along with a rate cut, the Fed simultaneously announced that it would be buying Treasuries.

From Reuters: “The Federal Reserve on Wednesday said it would imminently start buying short-dated government bonds to help manage market liquidity levels to ensure the central bank retains firm control over its interest rate target system.”

That’s a lot of words for saying: we’re going all out on monetary easing and inflation.

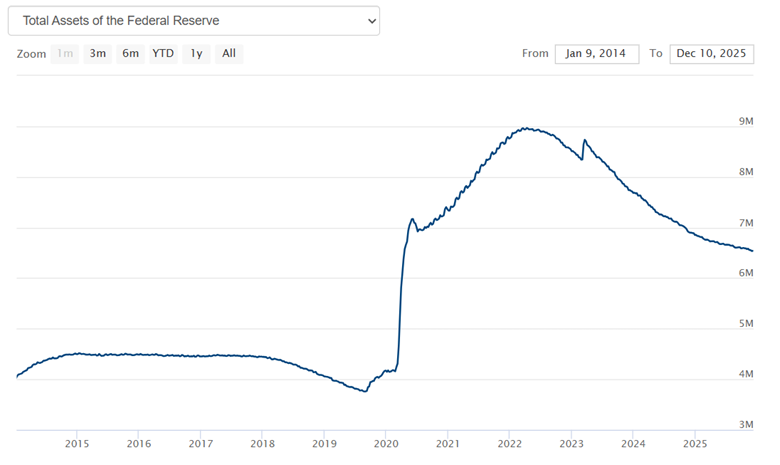

All of this Fed action is bullish for gold. Lower Treasury yields make gold more attractive by comparison, of course, but the real eye-opener is that the Fed will be buying something like $40 billion a month of Treasuries. Where does the money come from to buy Treasuries?

You already know the answer: they create it out of thin air. The Fed balance sheet is going to expand again.

Ever since 2022, the Fed has been trimming its balance sheet back, selling assets into the market in an effort to fight inflation. When the Fed sells these assets, the dollars come out of the market.

Now the opposite is happening. Despite their best efforts, we’re never going back to the pre-2022 balance sheet.

The coming months will be a return to all of the policies that created inflation a few years ago.

Except this time: we’re not coming out of a pandemic or a financial crisis. We’re easing while prices are already high.

It’s going to be a bumpy ride, which means you should expect volatility in gold and silver – and the miners – but the destination is obvious: much higher prices.

Best,

Garrett Goggin, CFA, CMT

Lead Analyst and Founder, Golden Portfolio